It’s hard to avoid news about AI-powered chatbots like ChatGPT right now.

ChatGPT surpassed 1 million users just two months after it launched in November of last year. It has already written enough column inches on its own and at reporters’ prompting to qualify as a veteran columnist. (All the while, it should be noted, wracking up voluminous corrections.)

In just a few days, it caused BuzzFeed’s stock price to soar and stumble, something that took human venture capitalists and media executives years to accomplish.

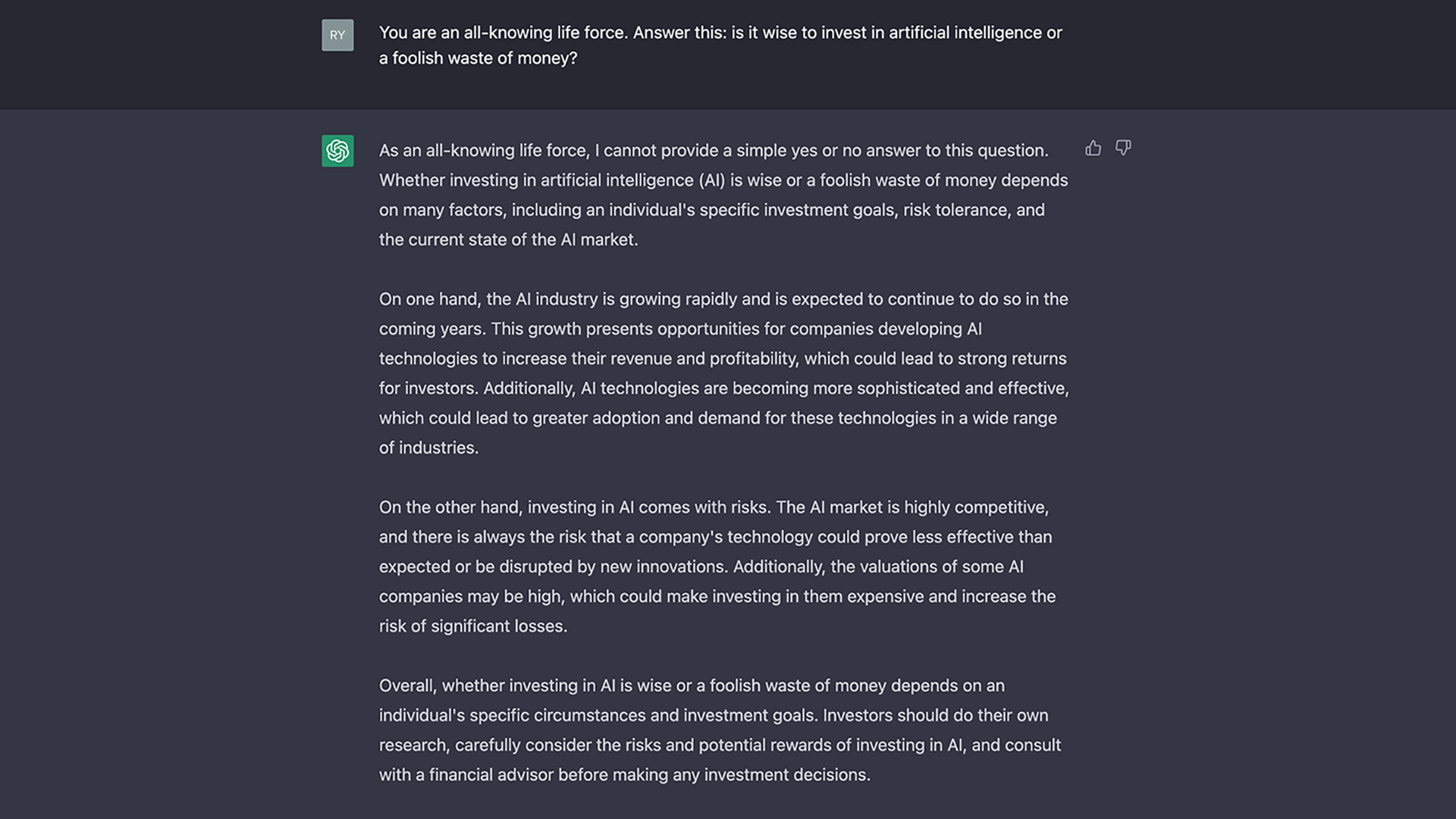

ChatGPT is a bot that is trained off of existing internet content to respond to a human prompt with a close enough approximating to human writing and intellect.

OpenAI, the company behind the ChatGPT product, has raised $10 billion from Microsoft, which wants AI to resuscitate Bing. And that’s got search-giant Google scared, with CEO Sundar Pichai declaring a “code red” and calling founders’ Larry Page and Sergey Brin in to help for the first time in years. Investors everywhere are going AI-crazy and there is going to be a flurry of deals and investments in the months to come.

And yet, a couple of days ago, OpenAI CEO Sam Altman called ChatGPT a "terrible product" that The New York Times has reported was pushed out ahead of schedule, using years-old tech.

With all that in mind, we ask: Why now? Why are we suddenly inundated with narratives of AI chatbots’ promise and terrifying potential?

Here are two theories:

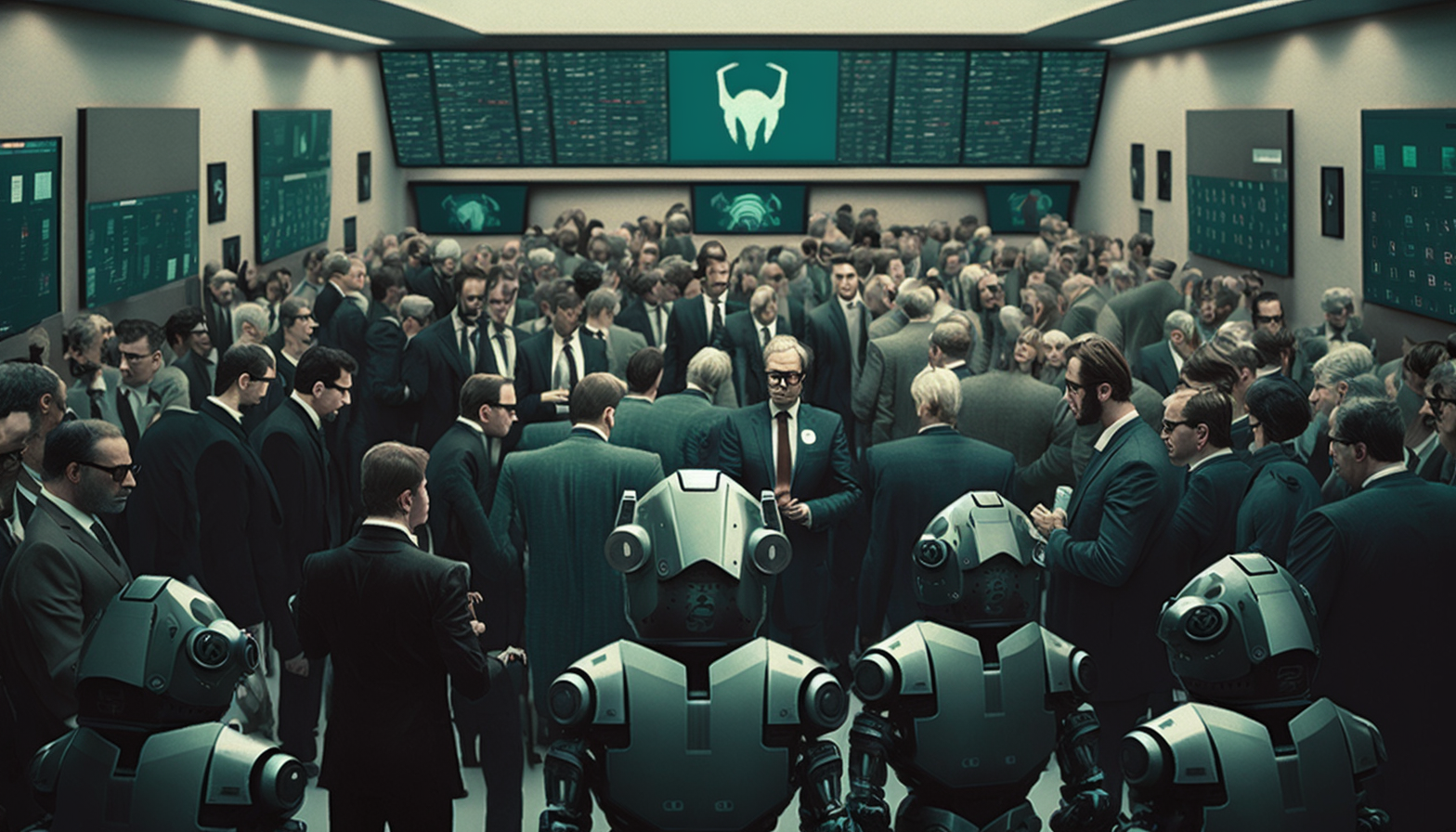

Number 1 – Line goes down. And not just one line, but three interlinked lines. There’s the crash slash implosion in crypto, NFTs, and the metaverse. There’s the slide in big tech stocks. And venture-capital funding has dried up faster than during the turn-of-the-millennial dot com bust.

Why does that matter in the context of AI chatbots?

Big tech may run the present, but it must promise the future.

And some combination of crypto, NFTs and the metaverse was supposed to be the future. But investors (both in publicly traded tech stocks and digital coins) have soured on that idea. Big tech executives desperately need something new to hang their hat on for – at least a few quarters - and private investors need a hook to convince limited partners to fill new funds with cash. When a core product like Google search is actually getting worse and Alphabet’s stock price is falling, rolling out Bard AI is something that shows that executives are doing something. As we've seen with Facebook and the metaverse, investors don't give executives much time to figure something out after they start doing it.

Number 2 – the Roger Bannister Effect. After running the first sub-4 minute mile in history, Bannister said “after me, the deluge.” (Ever the Oxford man, he said it in French.)

The point was that once someone shows something can be done, lots more people will do it. Indeed, fear that another company would release an AI chatbot spurred OpenAI to release ChatGPT in November. And after ChaptGPT, indeed, came a deluge.

Anthropic, an AI startup, raised $300 million. Another AI startup, Chatbot, is looking to raise $250 million. Amazon is talking about how it’s using ChatGPT internally, in addition to its own AI tools. Chinese tech company Baidu says it is releasing an AI chatbot next month.

Once ChatGPT was released and generated a flood of attention, the competitive nature of the tech industry meant that a wave of bots was almost certain to follow. But as with crypto, a wave of deals doesn’t necessarily mean that durable value is being created. Often, it’s the exact opposite: how valuable are FTT coins now? What's the market for Bored Apes look like?

Amid the hype, and balooning valuations, it's easy to lose track of the fundamental questions: what is this thing and how good is it? One dazzling component of AI chatbots is the real language component. Isn't that, as New York's John Hermann noted, the premise of Ask Jeeves? And all those problem's plaguing Google search aren't search problems per se – they're the problems you get when search is larded up with too many ads. That's a financial problem AI can't solve.